Insurance and Payment Policies

Insurance

Alpine Integrative Acupuncture, LLC accepts and bills insurance for in-network plans and as requested for out of network coverage. We are an in-network provider with AETNA. We are an out-of-network provider with other commercial insurance companies. We proudly care for Veterans as a network provider under the Department of Veterans Affairs (VA) Community Care programs. Unfortunately Medicare and Medicaid do not cover Acupuncture services.

AIA Billing Team

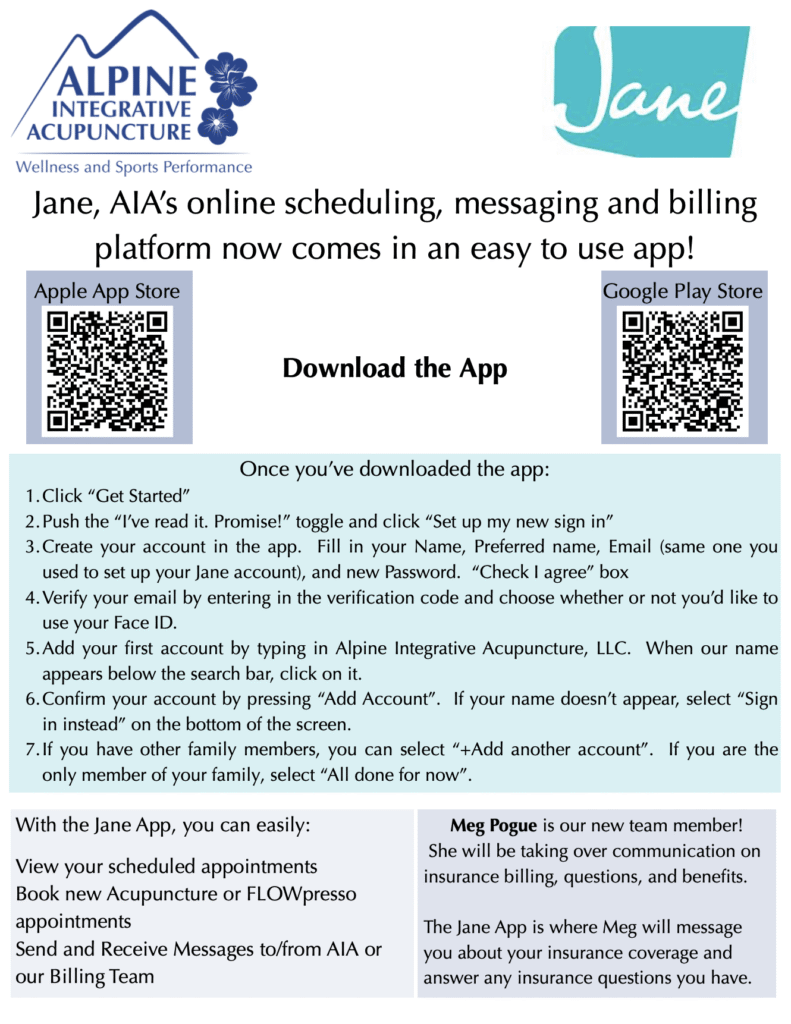

We are grateful to have Meaghan Pogue on our billing team. If you are an existing acupuncture client and have any questions related to your insurance, coverage, or invoices, please contact our billing team through the Jane App messaging feature. This can be found on the AIA Jane App desktop browser login or by downloading the ‘Jane for Clients’ App. We encourage clients to download the app to view appointments and message with our team.

Billing and Coverage

Please note that our office bills insurance as a courtesy to our patients. Your insurance information will be collected prior to your new client phone call. It is essential that you understand what insurance coverage you have and what you need to do to make the most of your coverage. We are happy to submit claims to your insurance, however payment is expected at the time of service. Charges sent to your insurance are your responsibility if the insurance company has failed to pay or respond after 60 days. For more in depth

Payment

Payment is expected at time of service. We accept cash, check, credit card, Visa, Mastercard, American Express, Visa Debit, Mastercard Debit and HSA/FSA cards.

Appointments

Alpine Integrative Acupuncture, LLC aims to provide each client with the best quality and care in a timely manner. Cancellations, late arrivals and no-shows are an inconvenience for all involved. With enough notice, we are able to provide services to another client who might be waiting to be seen sooner. Please review our office policies below:

Cancellations: Please be courteous and provide a 24-hour notice of cancellation. We will be happy to reschedule your appointment at this time. Clients who cancel with less than a 24-hour notice will be charged a late fee.

Late-Arrivals: We aim to have a smooth-running clinic for our patients! Please be on time, if not early, for your appointment. If you might be late, please call us to determine if you will be able to be seen. If you show up too late to be seen, then you may be rescheduled and charged a late fee.

No-Shows: Missing an appointment without contacting our front desk staff is considered a no-show. In addition to missing out on your time with your provider, you will be responsible for the no show fee.

Please read:

Insurance INFO and FAQ

Benefit Disclaimer:

Please note, not all insurance plans offer acupuncture benefits. A quote of benefits is not a guarantee of coverage. All coverage is subject to final approval by your insurance company and may differ from benefits quoted. Diagnosis and other restrictions may apply to coverage.

Medical Necessity:

All insurance benefits are subject to “medical necessity.” Medical necessity is a stipulation in the details of every health plan that outlines whether or not acupuncture is considered medically necessary to treat your condition. The insurance company sets these lists and they can be very narrow. This means even if you have acupuncture benefits, it might only be covered for a certain set of conditions. They are typically pain related, but every plan is different.

We will do our best to confirm what conditions your benefits may cover before we see you. If we can confirm this, we will communicate this information. However, because it is not always available to us prior to claim submission, we cannot guarantee your condition is covered until the claim is processed by your insurer.

We can always submit to in network plans and see what comes back. Should your claims be denied due to medical necessity, you will owe the cash price for your visits, $200.

Components of treatment:

Another thing to keep in mind with acupuncture coverage is the way insurance classifies the different aspects of treatment. Your provider will code your visit to match the different services provided as part of your treatment. While all these services are all part of providing a complete acupuncture treatment, they may be treated as different types of services by your health plan. Exams (a new exam or a re-exam used to re-evaluate care throughout a treatment plan), acupuncture itself, and manual therapies, like laser assisted manual therapy, can be considered different services to your insurance company. While some plans will cover all these services with the same cost share, some plans have what we call “split coverage,” meaning they may apply a different cost share to different types of services.

For example, you may have a plan that has a $30 copay for acupuncture. This same plan may consider the laser assisted manual therapy billed along with your acupuncture to have a different cost share, most commonly your physical therapy benefit. If your PT benefit is a 20% coinsurance, your plan will process the acupuncture at $30 copay and the cupping at 20% coinsurance. Another common example of this is a plan that has a $30 copay for acupuncture, but exams have a $60 copay. In this case, usually only one copay is applied on a single date and the higher of the two would apply, so a visit with an exam may process at a $60 copay. We will always do our best to confirm if your plan has split coverage, however we are not always accurately quoted this level of detail by insurance reps. Ultimately your cost share will be subject to final processing by your plan and we are legally obligated to charge you the cost share that results from final claim processing.

What to expect using insurance at our office:

The first step is providing your insurance card (front and back copies) for us to verify your coverage. We will provide a secure upload box for a copy of the front and back of your card as part of our electronic health record (Jane App) intake form. We must have a copy of the front and back of the card and your demographics to confirm your coverage. If you are unable to provide this information prior to your visit due to technical issues, please reach out to our client care team for assistance prior to your visit so we can make a plan (which may include texting a picture of your front and back insurance cards to our clinic phone or bringing it with you to your first visit depending on your technology comfort.). It is our preference to verify your insurance prior to starting care.

Once we confirm your coverage, we will inform you of the quote of benefits we received from your plan. If you receive care for a covered condition, we will submit the claims to your plan. Please note, if your plan requires a referral and we don’t have one at the time of service, you will be charged the cash price until the authorized referral is on file.

Claims typically take 4-6 weeks to process. Once the claim is processed, we will balance your account based on the claim outcome. If there is an overpayment, we will reimburse you either with an account credit to apply to future visits or by refunding your card on file. If there is an underpayment, we will make you aware with 48 hours’ notice before charging your card on file.

If your claims are denied, we will make you aware as soon as possible of the processing issues. If the claim is correctly denied due to lack of coverage, your card on file will be charged the cash price for incurred services. If we are disputing the denial, we will make you aware as we investigate the issue, but please keep in mind if a claim is ultimately found correctly denied you will be responsible for the cash price for all related services.

All insurance-related communication will be done via Jane messaging to keep your private health information secure and HIPAA-compliant. Please ensure you are logging into your Jane account when you receive notice so that you are up to date with insurance related information. You will be able to talk directly with our billing team if needed from your Jane account. You can access your Jane messaging either through your web browser or downloading the ‘Jane for Clients’. Click here to learn more about the Jane for Clients App.

What happens if I don’t have insurance benefits or I don’t want to use my insurance?

If your benefit inquiry results in no acupuncture benefits, we will indicate so below. If you do not have benefits, you will owe the self-pay rate. If you have insurance but would like to opt-out of using it, you may sign our election to self-pay form and skip using insurance. Just note, once signed you will need to pay cash for the remainder of the policy year and cannot switch to using insurance until the plan is renewed.

What happens if I have out of network coverage?

We are only in network with the following insurers: Aetna and EBMS

Any other insurance plan is considered out of network. As a courtesy to you, we can still check your benefits upon request. If you have out of network benefits and would like to go through your insurance, simply let us know at the time of your appointment, and we will provide you with a super bill, an itemized invoice you can use to submit to your insurance company for reimbursement. Reimbursement will go directly to you according to your plan’s specific cost sharing details.

Considerations for Blue Cross Blue Shield Policy Members

We are out of network with Blue Cross Blue Shield/Premera. We have outlined 3 options to consider based on your goals. If you have a high deductible plan, the most affordable option will depend on your goals. If you’d like to work toward your deductible, you can have us bill your insurance. Another option is for you to pay the self-pay rate and we can provide you with a superbill if you’d like to submit the claim yourself and have the amount paid in our office applied to your benefit. If you don’t plan on meeting your deductible, the most affordable option may be for you to instead purchase a prompt payment package where you get discounted rates on your sessions based on your package goals. For example, if your deductible is $3500 and you won’t be meeting your deductible that year, you could purchase a 15 session prompt payment package for $2,150. You would be saving the difference between the package rate per session and the self-pay rate and both of those rates would be a cost savings as compared to our standard rates. To recap you have 3 options: 1. AIA will bill your insurance directly using our standard fee schedule, 2. You can pay the time of service fee and receive a superbill so you can submit the claim to your insurance, 3. In place of utilizing your insurance, you can purchase a prompt payment package.

What happens if I have a deductible?

A deductible is a set dollar amount that you must pay out of pocket before your insurance company starts cost-sharing with you. For example, if you have a $2,000 annual deductible and a 20% coinsurance, you must pay $2,000 of covered medical expenses before your insurance will pay 80% and you will owe the remaining 20%.

If your deductible applies to your acupuncture benefits, we will submit claims on your behalf. You will owe the total amount allowed by the insurance company (as we are legally required), which will accrue towards your deductible. These rates are our standard rates. There is a slight discount for our time of service/ self-pay rates. Once your deductible is satisfied, your co-payment will kick in, and that is what we will collect at the time of service.

While we do track your deductible balance, you may have multiple providers billing your insurance company at the same time, so we can’t always have the most current balance of your deductible at any given point in time. If you make a payment in our office towards your deductible, but EOBs (explanation of benefits, your insurance receipt) comes in showing you made an over-payment, we will always reimburse you either through an account credit, reimburse back to your payment card or a check, whichever you prefer.

What happens if I need a referral?

There are a few different types of insurance plans that will require referrals from your primary care physician. If your insurance card says HMO or POS on the front, it’s a good indication you may need a referral to see a specialist.

If you need a referral for your acupuncture benefits, it will be listed below. You will need to contact your PCP and provide them with our NPI number. If you already came to see us before getting the referral, ask your PCP to backdate the referral to the first visit with us. Any claims submitted without a referral for plans that require one will always be denied.

An important note: don’t forget about medical necessity! The diagnosis your PCP puts on the referral will be reported to your insurance company. If acupuncture is not considered medically necessary for that diagnosis by your insurance plan, it is possible the claim will be denied. If you are being treated for a condition we know will not be covered by your plan, or if you are unable to obtain a referral from your PCP, you will owe the self-pay rates at the time of your appointment.

What is an out of pocket max?

The out of pocket maximum is the maximum amount of money that you will pay in a plan year before your insurance company covers the bill for the rest. For example, if you have a $5,000 out of pocket max, once you pay for $5,000 of covered medical expenses, your insurance company will cover the rest of your expenses until the end of your plan year, when your deductible, out of pocket, and visit limit balances re-set.

What is a visit limit?

A visit limit is the max number of visits your insurance company will cover in a single plan year. For example, if you have a 15 visit limit, your insurance company will only approve claims for 15 visits in one plan year. Visits accrue even if you are working on your deductible, so keep in mind if you have a high deductible plan, you may hit your visit limit before your hit your deductible. These tend to be hard caps, so while not all plans are the same, it is typically not possible to request more visits.

What happens if my plan year ends or I get a new insurance card?

At the end of every plan year, your insurance plan will either renew or term. If it renews and you did not receive a new insurance card, typically the means your coverage is the same. Insurers do make updates to benefits from time to time, so it’s always a good idea to let us know if your plan has renewed or if you received a new insurance card so we can re-verify your benefits.

If your plan terms, please notify us immediately. If we are not notified and your visits are denied due to termination of coverage, you will be responsible for unpaid visits. If you start a new plan, please let us know so we can verify your new coverage.

We know insurance can be confusing and we are here to make it as streamlined as possible! If you have any additional questions about your coverage or the process, don’t hesitate to reach out to our billing team by sending us a message in Jane!